Blog

Sole Practitioners: Benefits of Working with a Team

I regularly meet tax accounting professionals who are burned out from working in a large firm. Some of these brave souls have ventured out on their own to become sole practitioners. They tell me they are seeking independence and more freedom to advise their clients...

Making Life #LessTaxing!

This hashtag summarizes so much of what we do at Nichols & Company CPAs. We work hard to make life #LessTaxing for our clients by doing the “heavy lifting” of compliance and providing them with practical advice tailored to their unique situation. We also strive to...

Recently, the growing shortage of accountants made local news in my area. While there’s still a wealth of talent out there, many qualified professionals are turned off by the expectations of the Big 4 accounting firms. But it’s important to know that not all firms...

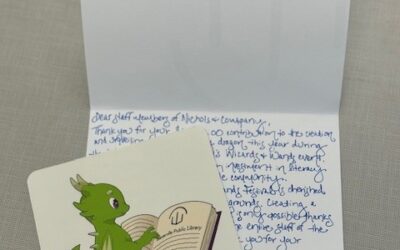

Helping Hatch a New Baby Dragon!

N&Co is so pleased to have made a donation to help bring a baby dragon to life at the Westerville Public Library’s annual Wizards & Wands Festival! This fiery little friend will be joining the festivities starting October 1st, spreading enchantment and delight...

Potential Changes to Tax Law Looming for 2026; Tax Professionals Advise Planning Now

If the Tax Cuts and Jobs Act of 2017 (TCJA) expires at midnight on December 31, 2025, your tax situation could be drastically altered. It is worth considering how these changes could impact you and plan now to avoid unnecessary surprises later. According to USA Today,...

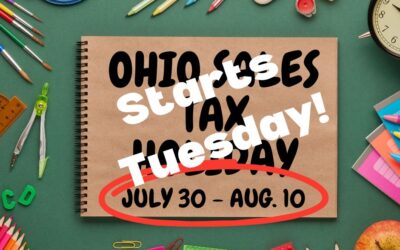

Almost celebration time: Ohio’s expanded Sales Tax Holiday starts July 30

Shoppers, start your engines. Ohio’s expanded Sales Tax Holiday will take place from 12:00 a.m. Tuesday, July 30 until 11:59 p.m. Thursday, August 8. The length of Ohio’s Sales Tax holiday has been expanded to 10 days and will allow tax-free purchases made in-person...

It’s National Intern Day — Introducing Nathan Morey

It's National Intern Day, and we would like to let our amazing intern, Nathan Morey, introduce himself: School/Major: Otterbein University; Finance major with a heavy minor in Accounting Anticipated Graduation Date: December 2024 What is your favorite part of working...

Important Changes to the FAFSA Form

The Federal Application For Student Aid (FAFSA) has undergone some significant changes designed to simplify the application process. Here are some key items to be aware of: Introduction of “Contributor”: A contributor is the new terms for anyone who is asked to...

From Tax Breaks to Eclipse Breaks

While we didn't close for the day, we did take a short break from preparing taxes to enjoy today's once-in-a-lifetime solar eclipse. All we can say is "WOW!"